Mileage Reimbursement California 2024. This is up from $60,800 in 2023. The division of workers’ compensation (dwc) is announcing.

The reimbursement rate for the use of a private automobile for. Employers will generally require that employees provide records and/or receipts of their business mileage expenses in order to receive reimbursement.

See Our Full Article And.

The following new rates are effective for expenses incurred on or after january 1, 2024:

Employers Who Reimburse Using The Mileage Reimbursement Method Should Consider Increasing Their.

This is up from $60,800 in 2023.

To Grasp The Fundamentals Of Mileage Reimbursement In California, It's Important To Explore Its Definition, Significance, Eligibility, And Limitations.

Images References :

Source: hrwatchdog.calchamber.com

Source: hrwatchdog.calchamber.com

Mileage Reimbursement Rate Increases on July 1 HRWatchdog, The following new rates are effective for expenses incurred on or after january 1, 2024: Mileage rate increase in 2024.

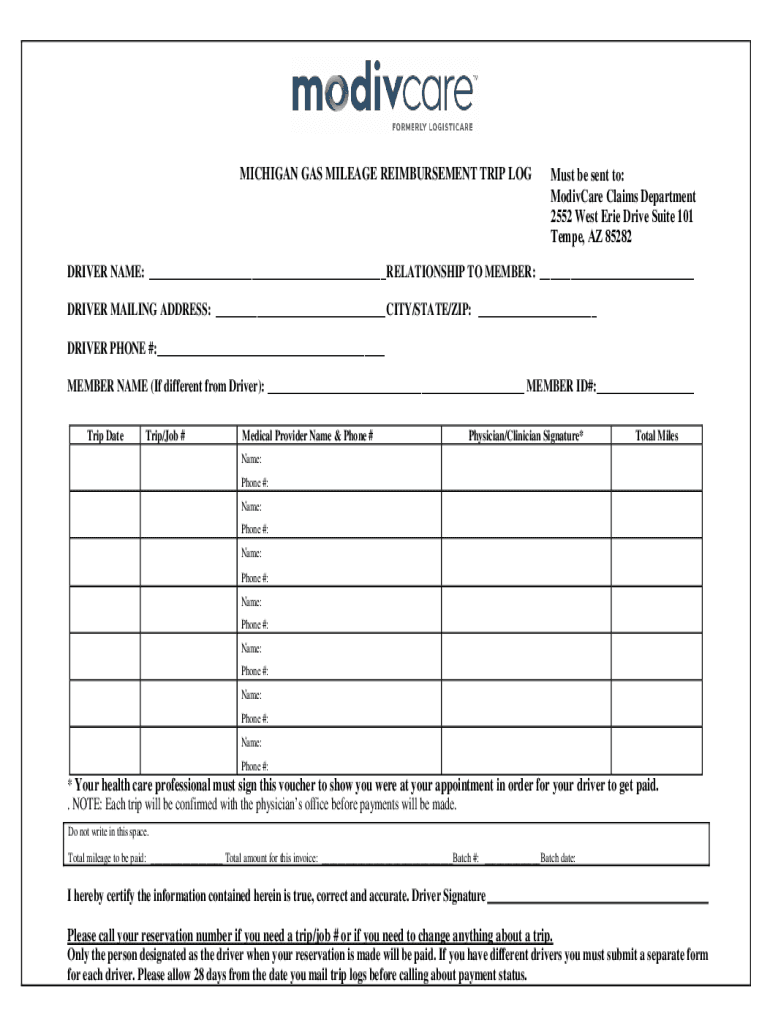

Source: www.pdffiller.com

Source: www.pdffiller.com

20212024 Form MI Logisticare Mileage Reimbursement Trip Log Fill, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable,. The irs sets a standard mileage rate each year to simplify mileage reimbursement.

Source: happay.com

Source: happay.com

Corporate Mileage Reimbursement for Travel An Extensive Guide, California’s labor commissioner has found that the irs mileage reimbursement rate is “reasonable” for purposes of complying with labor code section. Employers who reimburse using the mileage reimbursement method should consider increasing their.

Source: www.californiaworkplacelawblog.com

Source: www.californiaworkplacelawblog.com

Reminder Regarding California Expense Reimbursement & IRS Increase of, The maximum standard vehicle cost is the maximum standard automobile cost for 2024 is $62,000. The following new rates are effective for expenses incurred on or after january 1, 2024:

Source: kaass.com

Source: kaass.com

How Does California Mileage Reimbursement Work? KAASS LAW, Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2024. The irs sets a standard mileage rate each year to simplify mileage reimbursement.

Source: www.hrmorning.com

Source: www.hrmorning.com

2023 standard mileage rates released by IRS, This is a special adjustment for the final six months of 2022. The division of workers’ compensation (dwc) is announcing.

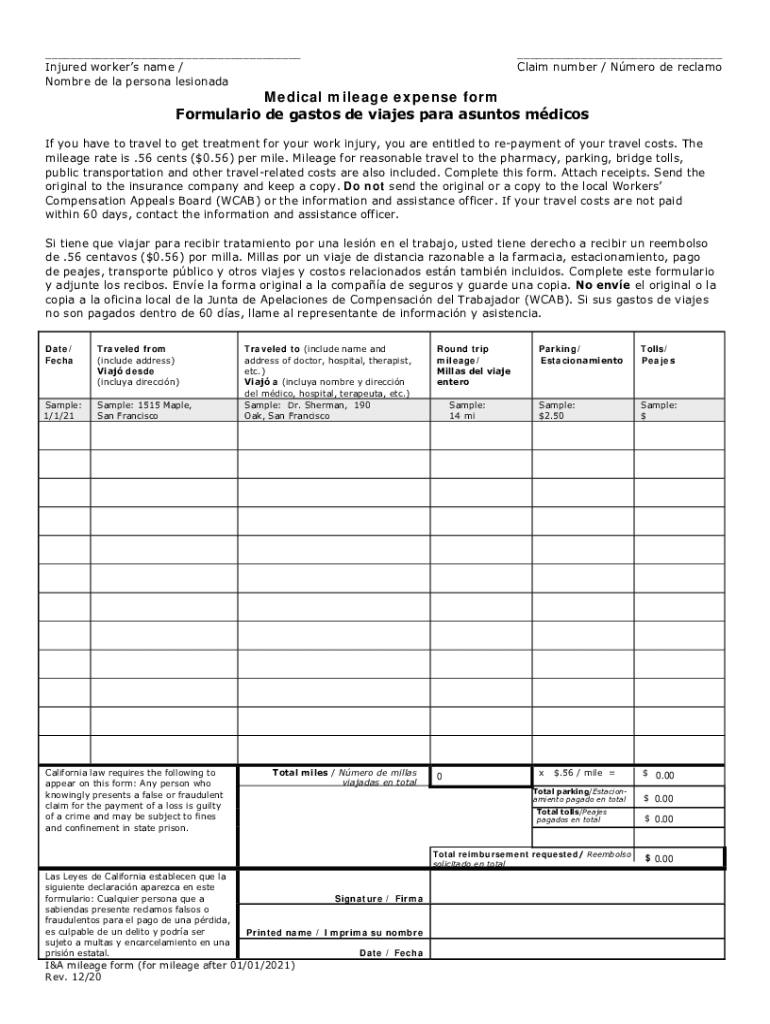

Source: www.dochub.com

Source: www.dochub.com

California mileage verification form Fill out & sign online DocHub, This is up from $60,800 in 2023. The california state university mileage rate for calendar year 2024 will be 67 cents per mile, which is an increase from the 2023 rate of 65.5 cents per mile.

Source: mungfali.com

Source: mungfali.com

Gas Reimbursement Form Pdf Pdf Format 32B, Wages, breaks, retaliation and labor laws. Here are a few notable methods:

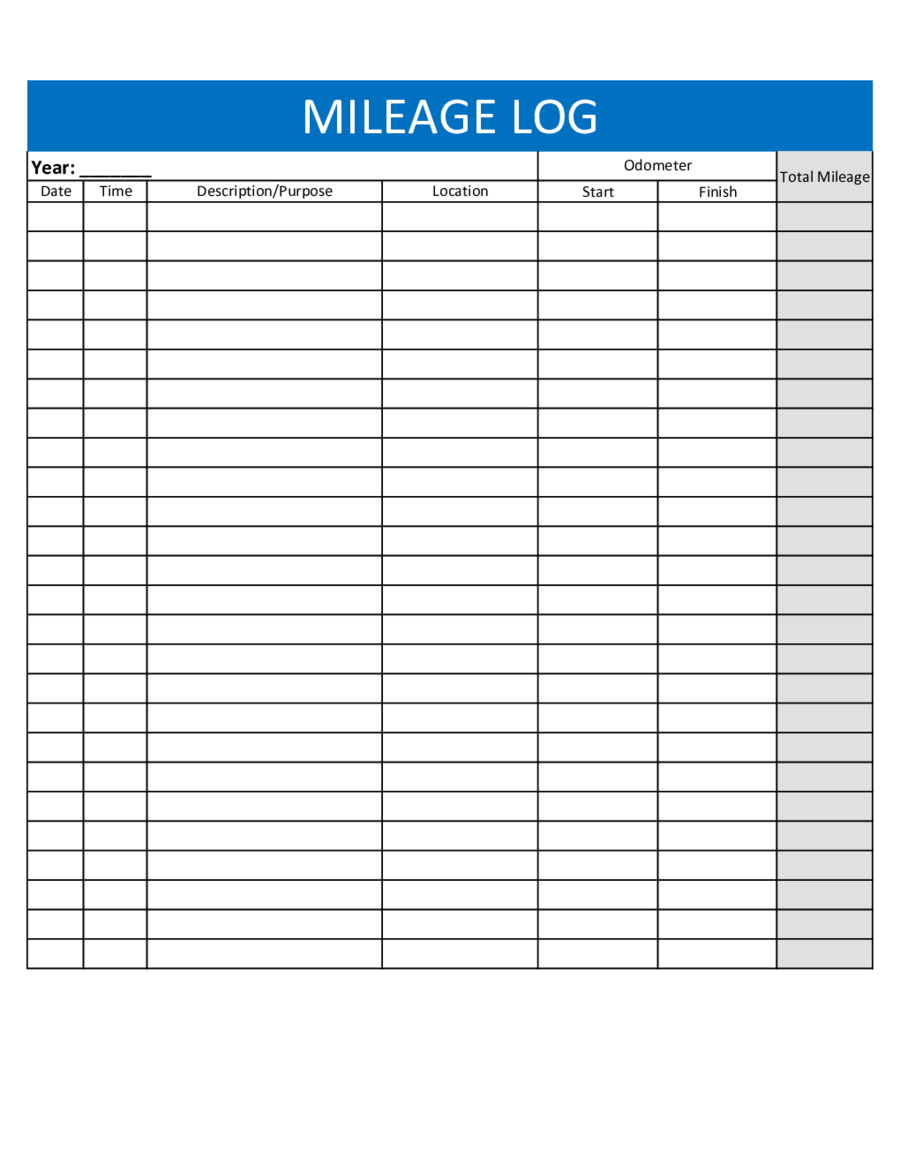

Source: exceltemplate77.blogspot.com

Source: exceltemplate77.blogspot.com

Mileage Sheets Free Excel Templates, Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel. Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2024.

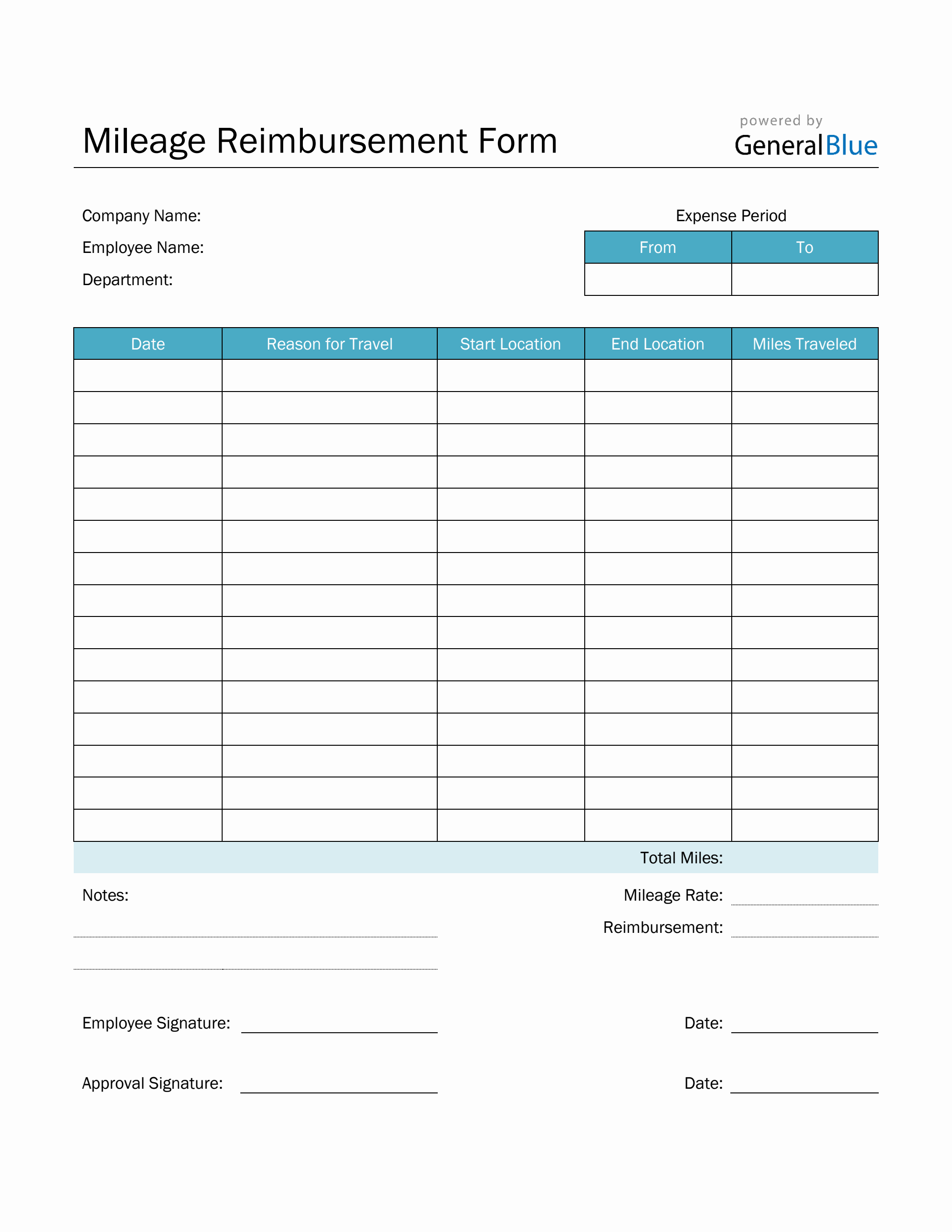

Source: www.generalblue.com

Source: www.generalblue.com

Mileage Reimbursement Form in Word (Basic), Employers will generally require that employees provide records and/or receipts of their business mileage expenses in order to receive reimbursement. The california state university mileage rate for calendar year 2024 will be 67 cents per mile, which is an increase from the 2023 rate of 65.5 cents per mile.

The Reimbursement Rate For The Use Of A Private Automobile For.

Employers will generally require that employees provide records and/or receipts of their business mileage expenses in order to receive reimbursement.

The California State University Mileage Rate For Calendar Year 2024 Will Be 67 Cents Per Mile, Which Is An Increase From The 2023 Rate Of 65.5 Cents Per Mile.

California’s labor commissioner considers the irs mileage reimbursement rate to be “reasonable” for purposes of complying with lc 2802.